Nitty Gritty of Annual Filing under ROC and Income Tax

Introduction

Annual Filling of companies is the procedure through which Government collects data financial and other important data of the Company in order to ascertain the transaction held during the year in the company and also the fact that all the would have been held as per the provisions of the Applicable laws. The Government have given a time frame within which the information related to a financial year is to be voluntarily provided by the Company. Delay in filling of this information could attract fine and penalties. Therefore, every Company needs to ensure that the filling is made within time to avoid fine and penalties.

Also it is the responsibility of person filling the form that correct information is provided and filed so as to avoid penal provision. The Income Tax Department and Registrar of Companies are the two main department to whom reporting is tobe made regularly

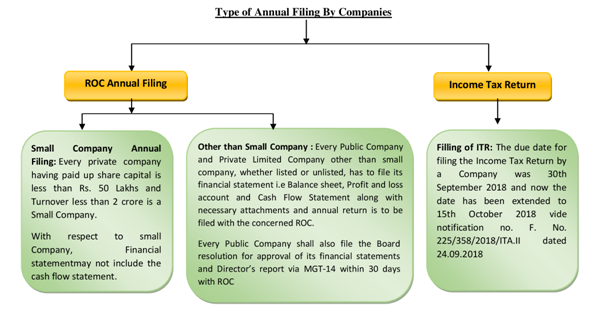

Therefore, the annual compliances which are to be done by the Company can be categorised as:

- Income Tax Compliances

- ROC Compliances

1. ROC Annual Filing Compliances

- Every Company after completion of particular financial year is required to submit the work done during the year before the shareholders of the Company via Annual General Meeting. For newly incorporated Company, First AGM can be held within a period of 9 Months from the date of ending of financial year and in all other cases, AGM can be held within a period of 6 Months from the date of ending of financial year.

- Further after holding of Annual General Meeting, every Company is required to file the Financials and other record and details of activities held during the year with the ROC via MCA Portal within the stipulated time (30 days and 60 days from the date of AGM) period within the prescribed form (AOC-4 & MGT-7).

- Let’s discuss in details, the needs to be taken care of while Filing Annual Forms with ROC:

- Preparation of Balance Sheet, Director’s Report and Annual Return: Every Company needs to prepare the record of financial transactions taken palace during the particular financial year. Therefore, all the financial transaction entered upon is to be presented in form of Balance Sheet and Profit and Loss Account and i.e. called Financial Statements and all the non financial transaction are consolidated in the form of Directors report. This Balance sheet along with the attachments and Directors report are clubbed together in the form of Annual report giving the overall insight about the Company during the financial year.

- Approval of Financial statement and conducting of Annual General Meeting: The Financial Statements as prepared shall be approved by the Board of Directors of the Company. Once the same is approved, they need to be audited by the Statutory Auditor. In case any qualification is raised by the Auditors, the justification regarding the remarks needs to be inserted in the Board Report. After that an Annual General Meeting is to be called so that the Annual Statement so approved is adopted by the Shareholders of the Company.

- Appointment of Statutory Auditor: Every Company is required to appoint a Statutory Auditor who shall independently audit the financial statement of a Company and giving his/ her remark on the conduct of business. The Statutory auditor shall be appointed in an Annual General Meeting for a period of 5 years. The Auditor shall hold office from 1st AGM till the conclusion of 6th AGM.

- Filing of AOC-4:

- Legal Provision: Section 129, 131, 134, 136, and 137 read with rule 5, 6, 7, 8, 9, 10 and 12 of the Companies (Accounts) Rules, 2014

- The Financial statement of the Company shall state true and fair view of the state of affairs of the Company and shall comply all the applicable accounting standards and would be according to Schedule III of the Companies Act, 2013

- Following information’s needs to be provided in the Board Report:

- According to the provisions of the section 134(3) of the Companies Act, 2013, points A to Q needs to be taken care in Board Report, someone the major points are produced below:

- the web address, if any, where annual return referred to in sub-section (3) of section 92 has been placed

- number of meetings of the Board;

- details in respect of frauds reported by auditors under sub-section (12) of section 143 other than those which are reportable to the Central Government;

- a statement on declaration given by independent directors under sub-section (6) of section 149;

- the state of the company’s affairs;

- According to above said provisions, every company needs to be financial statement along with Director Report and other attachment, in Form AOC-4 along with such fee as may be prescribed in the Companies (Registrations of Companies and Fees) Rules, 2014 within a period of 30 Daysfrom the date of holding of Annual General Meeting with ROC.

- Signing of Financial Statements: The financial statement shall be approved by Board of Directors and signed by the chairman on the behalf of the Board or by two directors out of which one shall be the managing director and the chief executive officer, if he is a director in the company, the Chief Financial Officer and the Company Secretary of the Company, wherever they are appointed.

- Signing of Board Report/ Director Report: The Director Report and any annexure shall be signed by its chairman of the Company if he is authorised by the Board and where he is not so authorised, shall be signed by at least two directors out of which one shall be the managing director or by the Director where there is one Director.

- Filing of MGT-7

- Legal Provision: Section 92 of the Company Act, 2013 read with rule 11, 12, 14, 15 and 16 of Companies (Management and Administration) Rules, 2014

- Companies Annual Return can be defined as an yearly statement which provide the necessary information’s about the Board Composition, Turnover, Profit, Net worth, Activity, Promoters, Remuneration etc. to its Member and stakeholders.

- According to the provisions of the Section 92 of the Companies Act, 2013, every Company needs to file an Annual Return, in the Form MGT-7 along with such fee as may be prescribed in Companies (Registration of Companies and Fees) Rules, 2014, within a period of 60 Days from the date of holding an Annual General Meeting with ROC.

- Further following documents may be required to attach while filing MGT-7 with ROC:

- List of Shareholders;

- List of Transfer;

- List of Debenture Holder;

- MGT-8*

- *A Company having the turnover of 50 Cr or more or having paid-up share capital of 10 crore or more shall be required to certify its Annual Return by a Company Secretary in Practice via MGT-8.

- Important points to be mentioned in the Annual Return:

- Its registered office and principal business activity and particular of its holding, subsidiary and associate companies.

- Its share and debenture;

- Its indebtedness;

- Changes in member during the year, if any.

- Its promoters, KMP details;

- Meeting of member or class of member;

- Meeting of board of Director and Committees, if any;

- Remuneration of directors;

- Penalty or punishment imposed upon the company or its officers;

- Signing of Annual Return: In case of Private as well as Public Company, Annual Return is required to be signed by the Director and Company Secretary and in case there is no Company Secretary, then by the Company Secretary in Practice.

- However, in case of small company as elaborated above, the same needs to be signed by the Company Secretary and in case there is no company secretary then by the Director of the Company. Means there is no requirement of certification of same by Company Secretary in Practice.

- DUE DATES

|

E-Form |

Nature | Attachment |

Due Date |

|

AOC-4 |

Filing of Financial Statements | o Director Report o MGT-9 o AOC-2, o CSR Report, o Audit Report etc. | 30 days from the date of AGM |

|

MGT-7 |

Filing of Annual Return | o List of Shareholders o List of Transfer o List of Debenture holder o MGT-8 | 60 days from the date of AGM |

- FINE AND PENALTY:

- To ensure timely and proper filling, penalty has been imposed not only on the Director and KMP’s but the same is also applicable on the professional certifying the documents. The fine and penalty imposed are:

- Late Fees for Delay in filling of Annual Forms:

- According to the provision of section 403 of the Companies Act, 2013, in case the Company fails to file its Annual Return forms i.e. AOC-4 and MGT-7, then it would be liable to pay Rs. 100/- Per Day penalty.

- In case of Default in filling of Annual Forms:

- Failure to File Financial Statement under Section 137

- According to Section 137 of the Companies Act, 2013 and the rules made thereunder, if the Company fails to file Financial Statement within the stipulated time period, the company shall be punishable with fine of one thousand rupees for every day during which the failure continues but which shall not be more than ten lakh rupees, and the managing director and the Chief Financial Officer of the company, if any, and, in the absence of the managing director and the Chief Financial Officer, any other director who is charged by the Board with the responsibility of complying with the provisions of this section, and, in the absence of any such director, all the directors of the company, shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than one lakh rupees but which may extend to five lakh rupees, or with both.

- Failure to File Annual Return under Section 92

- Pursuant to Section 92(5), if a company fails to file its Annual Return, before the expiry of the period specified therein, the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to five lakhs rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees, or with both.

- Further, If a company secretary in practice certifies the annual return otherwise than in conformity with the requirements of this section or the rules made thereunder, he shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees.

- Punishment for Fraud and Mis-statement under Section 447band 448

- As per Section 447 and 448 of the Companies Act, 2013, any person who is found to be guilty of fraud involving an amount of at least ten lakh rupees or one per cent of the turnover of the company,whichever is lower, or of any false or misstatement shall be punishable with imprisonment for a term which shall not be less than six months but which may extend to ten years and shall also be liable to fine which shall not be less than the amount involved in the fraud, but which may extend to three times the amount involved in the fraud. Further, where the fraud in question involves public interest, the term of imprisonment shall not be less than three years.

- Late Fees for Delay in filling of Annual Forms:

2. FILING OF INCOME TAX RETURN(ITR):

- Every Company, irrespective of turnover/income but having a PAN is required to file with the Income Tax Department an Income Tax Return depicting all the income and expenditure incurred by the Assesse during the financial year under review. All the details regarding income earned, expenses claimed and taxes paid shall be duly informed to the department through this return.

- Non-filling of Income Tax Return will attract the following consequences:

- Interest u/s 234A:Non filing of ITR within the stipulated time period may attract interest u/s 234A. Further if there are any taxes which remain unpaid, penal interest @ 1% per month or part thereof will be charged till the date of payment of taxes.

- Non-Carry Forward of Losses:In case the Company fails to file ITR, then it shall not be eligible to carry forward losses and hence cannot avail the benefit of the expenses incurred.

- Best judgment assessment (Assessment under section 144): The Assessing Officer is under an obligation to make an assessment to the best of his judgment in the following cases:

- If the Assessee fails to file income tax return within the stipulated time period under section 139(1) or a belated return under section 139(4) or a revised return under section 139(5).

- If an Assessee fails to comply with the terms and conditions of a notice issued under section 142(1).

- Thus, Non-Filing of the Income Tax Return may result in the Best Judgement Assessment and the same has been carried out according to the best judgment of the Assessing Officer on the basis of all relevant material he has gathered.

- Claim of Refund of Taxes: By filling ITR, an Assesse can claim the refund of excess TDS if the TDS deducted is more than the tax liability of the Company by filing your Income Tax Return. You must file your Income Tax Return to claim the refund of TDS Further, the assessee are eligible for interest on refund amount as per Section 244A.

- Penalty for Concealment of Income: If the company has earned income and do not file the return of Income, the Company may end up paying penalty for concealment of Income.

CONCLUSION

Since heavy fine and penalties have been imposed for non filing or for default in filing of Annual Return. Therefore, it is advisable to file the same due on time before its too late.